In: New Roads and Street Works Act 1991

Get in contact if this compliance training session would be of use to your teams and reduce legal and financial risks to your buisiness.

Get in contact if this compliance training session would be of use to your teams and reduce legal and financial risks to your buisiness.

The delegate feedback below is from recent delivery of the following compliance training sessions:

- NRSWA and TMA criminal and financial risks seminar; and

- Operational team briefing – Street works legal risks.

As a matter of course, we do not disclose details of our client organisations or personnel.

Get in contact if we can assist with your compliance training needs.

“Was very good and knowledgeable”

“All staff should attend this course”

“Managed to keep interest of Legal team and Depot team managers”

“Tom was knowledgeable and engaging and put info across in a way that was understandable”

“Tom was very knowledgeable and explained everything clearly and kept us interested and involved all the time”

“Trainer was spot on. Very enjoyable”

“Course exceeded my expectations and was delivered very well”

“Real world examples and explanations given by Tom helped me gain a greater understanding”

“Tom was engaging throughout”

“Great course. Trainer, Tom Ward, was brilliant. Made course enjoyable”

“Very knowledgeable trainer”

“The course was very enjoyable and the trainer Tom Ward had very good hands on experience”

“Opened your eyes to the bigger picture”

“Good course, well presented”

07/09/2023

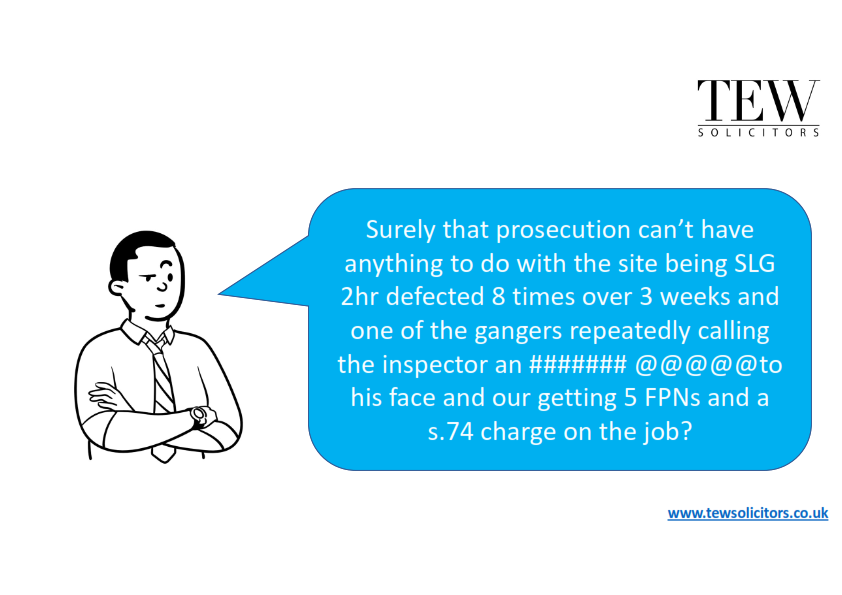

Bodge it Bob strikes again (and again…)

We’re seeing and hearing of an increasing number of instances of undertakers finding:

1. Someone has buried their apparatus under concrete ; or

2. Covered over access points for valves etc; or

3. Their apparatus has been damaged and “repaired” by parties unknown; or

4. A combination of all of the above.

The first the undertaker is aware of this is usually when they do routine maintenance or a problem is reported with their network and they can’t locate their apparatus or find it in a condition they did not expect.

Aside from NRSWA containing a process for damage claims and diversionary works (and there being legal remedies for undertakers whose apparatus is so impacted), the wider concern here has to be with the potential safety risks of some of these actions. Any of them can pose risks to life and property.

To our mind, whilst all of the examples are serious, the most immediately dangerous is the “Bodge it Bob” repair to 3rd party apparatus. Whilst there may be occasions in which a party undertaking works might genuinely be unaware of damaging 3rd party’s apparatus, the “Bodge it Bob” repair is not one of those. “Bodge it Bob” is actively seeking to conceal damage to and repair of 3rd party’s apparatus. Whether such a repairing party has the professional skills and credentials to do the repairs to the standards of the owning 3rd party is not the issue (and is seemingly rarely the case). They are working on the apparatus of a 3rd party without that party’s knowledge or consent.

“Bodge it Bob” repair works, often using incorrect materials and fittings, to 3rd party apparatus pose immediate safety risks to the individuals undertaking them. To then conceal the damage and unauthorised (and invariably bodged) repair poses wider safety risks to any other party working in the vicinity of the apparatus and the public. OK, one might save a few quid and some time, but the safety risks for the worker doing the “repair”and those potentially created for entirely innocent 3rd parties are unconscionable.

We mention above the NRSWA processes for damage claims and diversionary works. There’s also HSG47. They’re all there for a reason, not that they will stop this type of behaviour. Most people use them. Yes, using them may cost time and/or money, but the flip side is that part of the reason they exist is to reduce the risk of someone being killed or seriously injured. The longer “Bodge it Bob” works continue, the greater the chance someone will be killed or seriously injured.

If you know a “Bodge it Bob” who does this or is instructing their teams to do this, perhaps you could gently highlight the error of their ways to them? You might also let them know that things may become a bit legally and financially unpleasant for them…

Are you wanting your leadership/ management team to have a clear understanding of streetworks criminal liability risks?

This concise briefing session may be of interest.

Email [email protected] for further details and costs.

Outline brochure for current briefing session. Contact us for booking details.

Outline brochure for current briefing session. Contact us for booking details.

Over recent months we have run a series of online and face to seminars aimed at prolonged occupation charge risk mitigation for clients on the undertaker side of the street works ‘fence’. Delegate feedback has included the following comments:

“This is a must course for Street Works and Site Managers. The pitfalls are numerous and Tom delivers the main issues and how to avoid them. Highly recommend this course”

“Thanks for today, took some real pearls of wisdom that I’ve already spread round the office like wildfire!!”

“The course was very informative and explained really well to even those that had little to no experience with regards to the subject would understand clearly”

“Great insight into the legislation behind s74s and Tom Delivered this in a way that was engaging and thought provoking”

“delivery of seminar was very good and to the point, Tom is very knowledgeable and answered all questions throughout the seminar in good details that were easy to understand”

“Delivery was concise and gained the full attention and interaction of the audience throughout the seminar. I remained fully engaged. The opportunity to listen to the viewpoints of others were carefully considered and responded to appropriately. I felt included and particularly liked that there were people from different organisations, brought together by their mutual interest in NRSWA related activities.”

“Very in depth review of Section 74s and pinpointing key parts of the legislation to analyse.”

“I really enjoyed the way it was presented, very interactive involving the delegates in a positive manner”

“I thoroughly enjoyed the course and didn’t want to leave for my other meeting. I found that I learnt a great deal about the nuances of S74 from you. Thank you Tom”

Do get in contact if you are interested in us delivering compliance training to your team.